One studio that won’t be changing its new business model is the one that has been the most successful.

Everyone else isn’t getting the subscriber numbers to ditch the theatres.

The others are not clearing $1B a month from their streaming service, plus the studio also is making as much, if not more money from their 60 day buy it upfront as they would if they had to split money with theatres and marketing and so much more. There is talk about them scooping up a bankrupt movie chain and branding it under their own name.

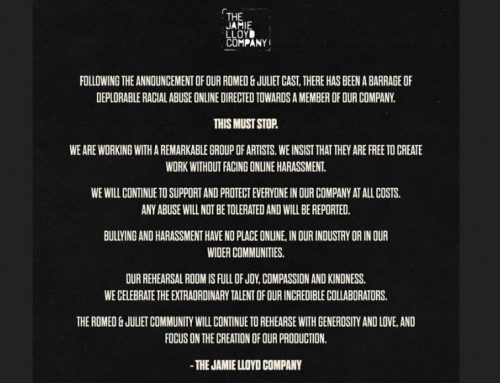

Disney

Alamo Drafthouse

From the Alamo Drafthouse Bankruptcy to Refusing to Play Disney, It’s All About Exhibitor Survival

After a devastating 2021, exhibitors are united in their desire for survival. Their approaches are not.

For Alamo Drafthouse, that means Chapter 11 bankruptcy reorganization, closing three locations, and selling out to a private-equity investment group, with Alamo founder Tim League retaining a minority stake.

For Cinemark, it means turning away the opportunity to play Disney’s animated “Raya and the Last Dragon” March 5.

Nearly a year after domestic theaters closed in response to the growing COVID-19 threat, exhibitors face another reckoning: Now What? Their core business of showing movies for profit remains the same, but each theater or chain must also confront its own sets of strengths and weaknesses in order to move forward. That process places them on many different paths.

The Drafthouse reorganization, announced March 4, will allow its 37 owned-and-operated locations (as opposed to their franchises) to operate in the short term, increase their ability to negotiate with landlords, and potentially regroup. It’s a sequence we did not see with the much-larger AMC, which has been able to refinance without bankruptcy protection. – Source

Read more on these Tags: Disney