Source: http://www.crazydaysandnights.net

Better Hurry Up – Mr. Hedge

This always-thirsty foreign born A list model has a checkered relationship history.

Her husband is the CEO of a company you all know.

Her husband recently raised some much-needed dough, by selling some of the stock he owns.

Since their wedding, this was the first sale her husband has made to get more liquidity.

Almost all of this CEO’s eye-popping wealth is on paper.

That will mostly evaporate. If he wants to ensure a lifetime of wedded bliss, he had better keep selling, and quickly.

The IPO of his company was almost a year ago.

The company was and is valued in an outrageous fashion, at far higher levels than peers.

Despite this, it has done almost nothing but disappoint its investors, again and again.

His company is not really much of a business at all.

It does nothing but burn through lots of cash pretty quickly.

For every $2 in sales they generate, they burn through over $1 in cash.

At present rates, they have about 2 years of cash left.

There is a great deal of competition from larger players already, and his customers really hate the recent changes he made.

A list model: Miranda Kerr

Husband/CEO: Evan Spiegel – Snapchat

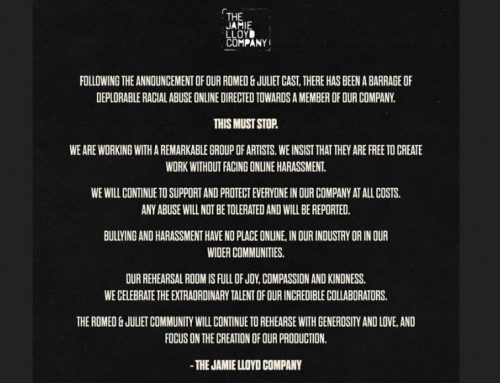

Snap slides after Evan Spiegel sold shares and Citigroup downgraded the company

Snap fell as much as 6% Tuesday after Citigroup downgraded the stock to sell from neutral and lowered its price target to $14 a share.

While Citi acknowledged that the redesign could have a positive long-term impact on the photo-sharing company, it cited an app review from App Annie showing that, since November, Snap’s apps reviews have declined. Five star ratings went from 2.1% to 1.3% in that span, and one star ratings went from 28% to 86%.

“While the recent redesign of [Snap’s] flagship app could produce positive long-term benefits, [there is a] significant jump in negative app reviews since the redesign was pushed out a few weeks, which could result in a decline in users and user engagement, and could negatively impact financial results,” analysts Mark May and Hao Yan wrote.

Tuesday’s selling may also be related to CEO Evan Spiegel selling $50 million worth of shares, or about 1% of his holdings, last week. The share-sale was his first since Snap went public a year ago.

Spiegel still maintains about a 10% stake, and has a total fortune of $4.5 billion. – Source

Read more on these Tags: Evan Spiegel, Miranda Kerr